Call: 0845 139 4444

Email: hello@square4.com

Call: 0845 139 4444

Email: hello@square4.com

Financial services firms face unprecedented regulatory pressure under the FCA’s Consumer Duty. Manual outcomes testing is expensive, inconsistent, and too slow to scale across complex customer journeys.

Assure 4 changes that.

AI-driven outcomes testing that is scalable and objective

Real-time monitoring across the customer lifecycle

Up to 80% cost savings compared to manual teams

Audit-ready assurance for Consumer Duty board reports

Assure 4 is trusted by leading firms and powered by CourtCorrect’s AI technology with Square 4’s award-winning regulatory expertise.

Built on Square 4’s Award-Winning Outcomes Framework. Assure 4 leverages Square 4’s ICA award-winning methodology, ensuring clarity, consistency, and regulatory confidence.

Customer journeys we monitor

Onboarding

Vulnerability

Servicing

Complaints & Disputes

Collections

Offboarding

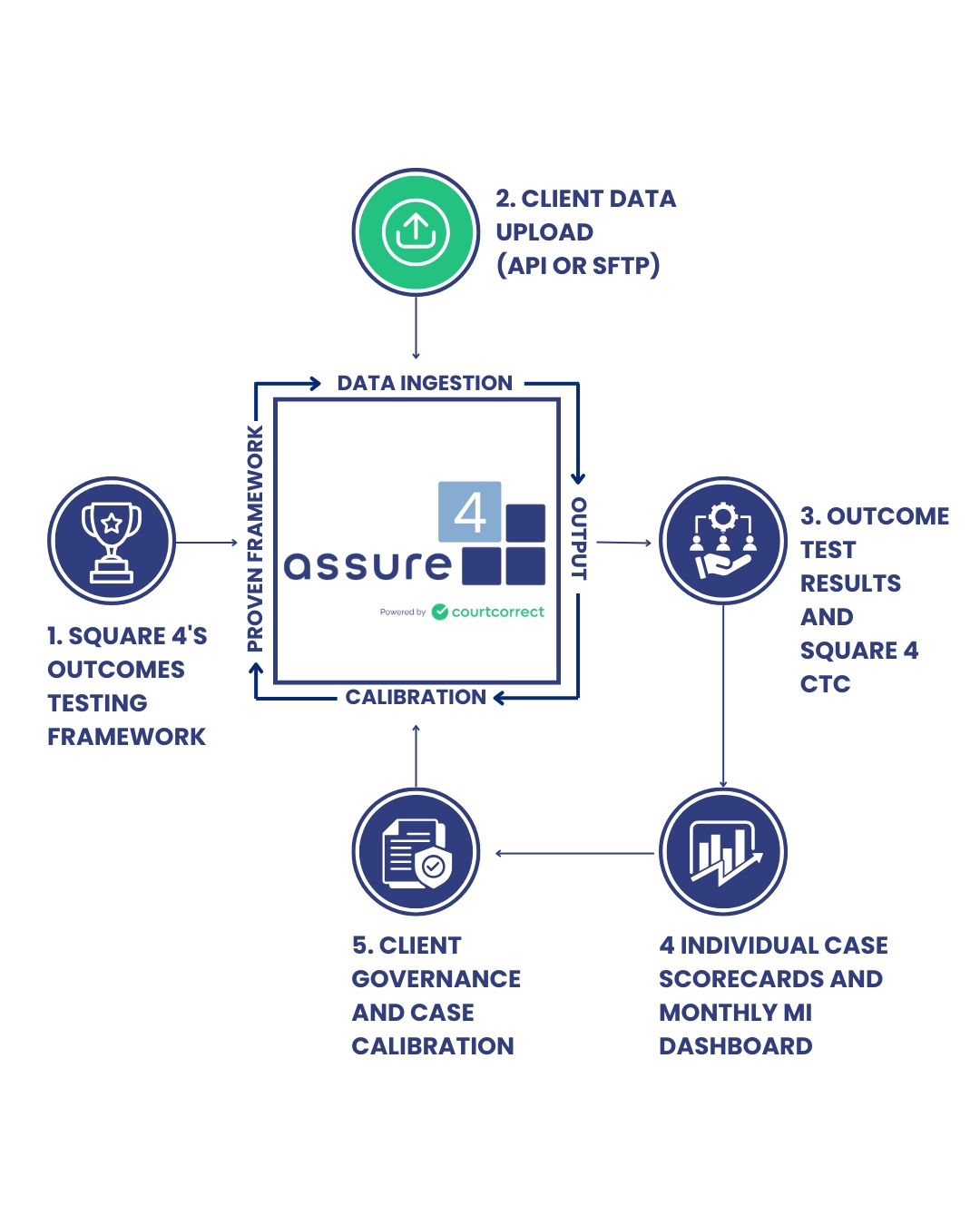

This creates a closed-loop system that ensures every journey is tested, monitored, and enhanced over time.

Assure 4 is more than compliance. It’s a data-driven assurance solution designed to:

Increase volume and frequency of checks across customer journeys

Deliver predictive insights into customer behaviours and risks

Integrate seamlessly with existing CRM and oversight platforms

Improve customer trust by detecting and preventing harm early

Flexible Delivery Models

Off-the-Shelf: Pre-configured for rapid deployment

Fully Bespoke: Tailored to your existing outcomes testing methodology

Key Benefits

AI + Human Expertise

Automation backed by Square 4 regulatory specialists

Up to 80% Cost Savings

Reduce reliance on manual teams

Audit-Ready Evidence

Board-ready reports and regulatory assurance

Fast Deployment

Plug-and-play with minimal IT setup

Scalable & Flexible

Analyse thousands of interactions instantly

Enhanced Protection

Identify and prevent customer harm to build trust

Limited monitoring in place?

We fast-track your Consumer Duty compliance.

Launching a new product?

Ensure good outcomes from day one.

Preparing board reports?

Use audit-ready outputs and analytics.

Short on resources?

AI handles scale while our experts assure quality.

What is outcomes testing?

Outcomes testing is the process of checking whether customers are actually receiving “good outcomes” at every stage of their journey with a financial services firm. It goes beyond traditional quality assurance, which often only checks whether staff followed the right process or used the correct system steps. Instead, outcomes testing focuses on the real-world impact on the customer.

Who is Assure 4 for?

Regulated financial services firms of all sizes needing scalable outcomes testing, cost reduction and efficiency and stronger regulatory and customer experience insight into key business journeys.

How secure is it?

All data is protected via CourtCorrect’s advanced security measures with certified security protocols and a locked down environment for your business.

How quickly can it be deployed?

Choose from rapid off-the-shelf deployment or longer term, fully bespoke models tailored to your firm.

How can we share data with you?

Data can be shared manually via SFTP or a secure upload portal or we can fully integrate with front end systems using a secure API key.

Why Square 4?

Trusted by leading firms, recognised by the ICA for compliance innovation, and uniquely partnered with CourtCorrect for AI-powered assurance.

Sign up to our Insights